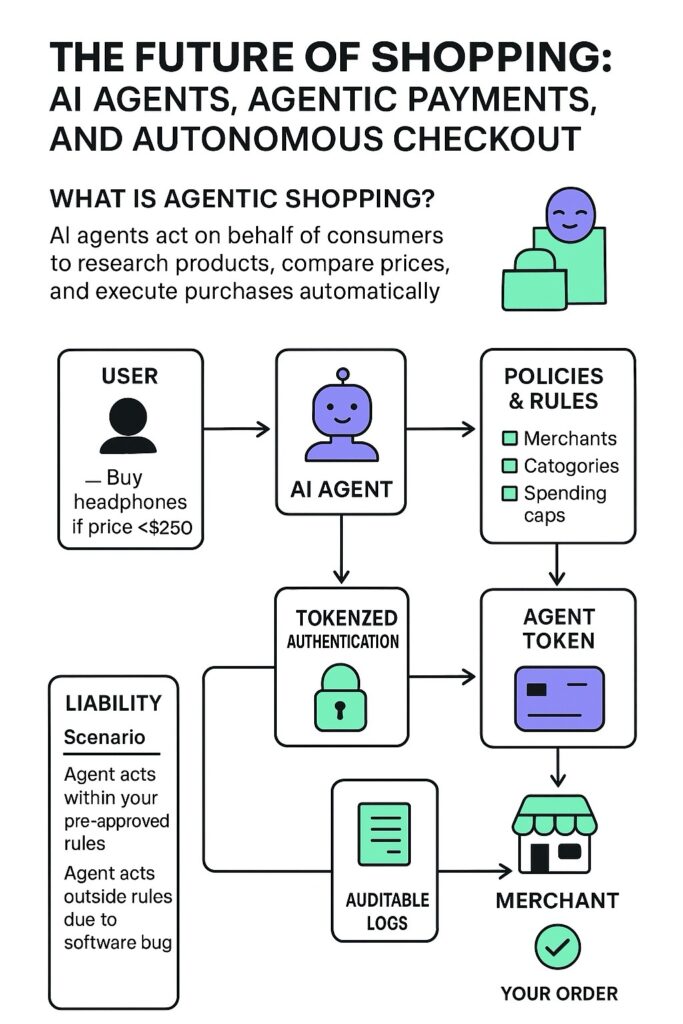

The Future of Shopping: AI Agents, Agentic Payments, and Autonomous Checkout

Imagine a world where your personal AI agent can shop for you, hunting for the best deals, monitoring price drops, and completing purchases — all without you lifting a finger. Welcome to the emerging era of agentic shopping.

In this blog post, we’ll break down:

- what agentic shopping is and how it works

- the current landscape of payment innovations like Mastercard Agent Pay and Google’s AP2

- the challenges with screen scraping

- and how liability is managed in these automated systems.

What Is Agentic Shopping?

Agentic shopping refers to a new model where AI agents act on behalf of consumers to research products, compare prices, and execute purchases automatically. These agents are not just simple scripts; they are designed to make autonomous decisions based on rules and preferences you define.

For example, you could tell your agent:

“Buy the Sony headphones if the price drops below $250 in the next 30 days, and only from trusted retailers.”

Once you set these rules, the agent monitors the market continuously and executes the transaction when conditions are met.

Who Provides the Shopping Agent?

There are two main models:

- Merchant-provided agents Integrated directly with the store or marketplace. Offer perks like loyalty points, discounts, and fully integrated checkout. Limited to a single merchant’s ecosystem.

- Third-party agents Provided by banks, fintechs, or independent AI platforms. Can shop across multiple merchants and compare deals. Require tokenized credentials and secure integration with payment networks.

Some ecosystems use a hybrid approach, allowing both merchant-specific and independent agents to operate together.

How Does the Agent Authenticate You?

To shop on your behalf without exposing your credentials or requiring your presence, agents rely on tokenized, delegated access:

- Scoped tokens: Allow purchases only within merchant lists, spending caps, and categories you authorize.

- Device-bound tokens: Ensure only your agent runtime can use the token.

- Rule-based automation: Low-risk purchases can happen automatically; high-risk or unusual purchases trigger push notifications for approval.

- Auditable logs: Every purchase includes intent metadata so you can trace which agent action triggered the transaction.

This approach ensures a balance between convenience and security.

Can Screen Scraping Work for Agentic Shopping?

Screen scraping — where an agent imitates a human to navigate websites and submit purchases — could technically work, but it comes with serious limitations:

Fragility: Website layout changes can break the agent. Anti-bot measures: Cloudflare, Akamai, and other protections can block automated purchases. Security & compliance risks: Storing user credentials or bypassing merchant APIs raises regulatory concerns.

In short, screen scraping may be used as a temporary hack, but the long-term future lies in tokenized APIs and structured agent-to-agent protocols.

Mastercard Agent Pay and Citi’s Role

After reading through Crone Consulting’s LinkedIn post, I was a bit confused. What’s Citi exactly planning to do? I could not find any information on any move by Citi online.

Mastercard’s Agent Pay is a framework that allows banks like Citi to issue agent tokens for secure, automated payments. It aligns with the vision of agentic shopping by:

Tokenizing credentials instead of sharing raw card data. Supporting multi-merchant shopping (if merchants accept the token). Enabling Know Your Agent (KYA) handshakes — a trust layer between agents, banks, and merchants.

Citi is an early participant in Agent Pay, exploring how AI agents can execute payments safely and autonomously for cardholders.

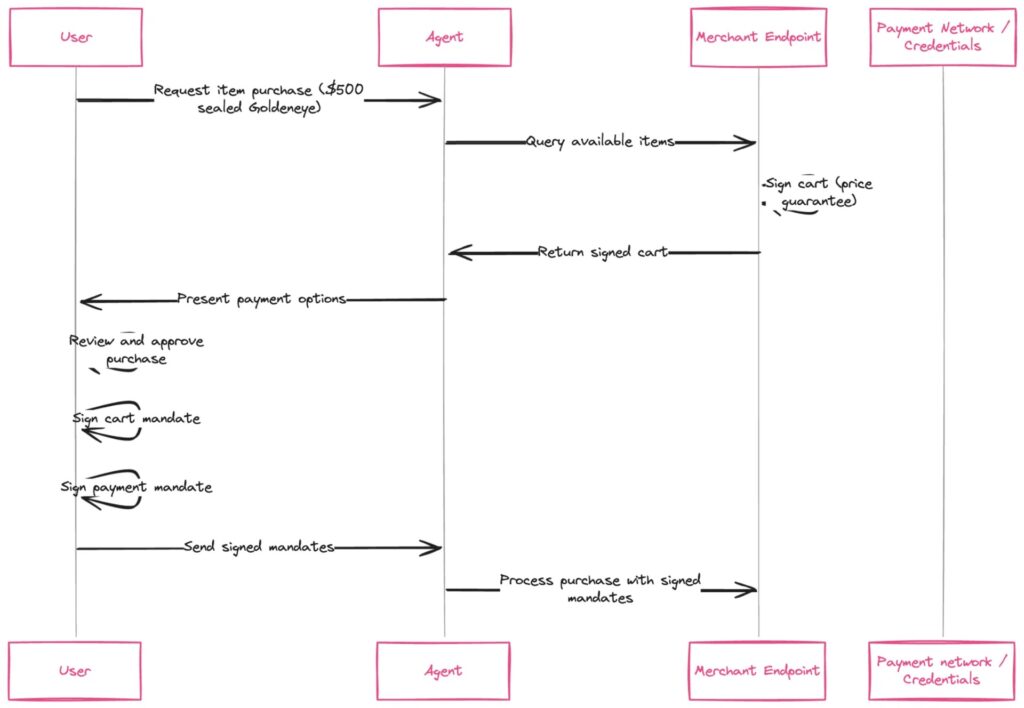

Google’s AP2: Standardizing Agentic Payments

Google recently announced the Agent Payments Protocol (AP2), a standardized framework for secure AI-agent transactions. AP2 introduces three types of mandates:

Cart mandate (human present) – The user is actively present, decides “I want to buy this now,” and provides immediate authorization.

Intent mandate (human not present) – The user expresses intent to purchase when certain conditions are met. Both merchant and user pre-agree and cryptographically sign to authorize the transaction once those conditions occur (e.g., “Buy headphones if price ≤ $250”).

Bank & payment mandate – Granted to banks and payment providers and potentially enables visibility into transactions for dispute resolution and fraud protection.

AP2 ensures security, transparency, and auditability, addressing trust and liability concerns while enabling multi-agent interoperability across merchants and payment providers.

(From Fintech Brainfood by Simon Taylor)

Liability in Agentic Shopping

Scenario: Agent acts within your pre-approved rules

Who’s Responsible?: User

Notes: You consented to the purchase.

Scenario: Agent acts outside rules due to software bug

Who’s Responsible?: Agent provider or bank

Notes: Fail-safes and revocable tokens protect the user.

Scenario: Agent compromised by a hacker

Who’s Responsible?: Bank or payment network

Notes: Tokenization and fraud monitoring reduce user exposure.

Scenario: Merchant fails to deliver or misrepresents product

Who’s Responsible?: Merchant

Notes: Normal dispute channels apply; agent attribution is included.

What the Future Looks Like

Agentic shopping represents a major shift in e-commerce:

Consumers get personalized, automated shopping experiences. Banks and fintechs offer secure AI agents that compete to capture the “starting point” of the shopping journey. Merchants can benefit from higher conversion rates but must adopt agent-friendly APIs. Screen scraping may exist temporarily, but the future will be tokenized, secure agent-to-agent protocols, like Mastercard Agent Pay and Google AP2.

Final Thoughts — Choose Yours 🎯

Option 1: Euphoric 🚀

AI shopping agents are no longer a futuristic concept — they are becoming real through tokenized payments, agentic commerce frameworks, and secure protocols. The combination of user-defined rules, secure authentication, and interoperable standards like AP2 makes it possible for AI to act autonomously while keeping you in control. This new paradigm is set to redefine how we shop, turning everyday purchasing into a smarter, safer, and more efficient process.

Option 2: Realistic 🛠️

AI shopping agents are moving from concept to reality, enabled by tokenized payments, agentic commerce frameworks, and secure protocols. With user-defined rules, secure authentication, and interoperable standards like AP2, AI can act autonomously while keeping users in control. But adoption will depend on trust, clear rules, and smooth integration with existing systems. It’s an exciting evolution, but one that will happen step by step.